• Prepayment program starts in January and August of each year

• Takes your ½ tax total and divides into 6 payments (5 coupons 1 balance due tax bill)

• Can also pay by automatic withdraw

• Contact the office, if you are interested 419-334-6234

• Escrow Agreement Form for the prepay escrow application

Escrow Real Estate Question & Answers

Do I have to pay the exact amount indicated on my coupon?

No. This is a suggested figure. It is up to you as to how much you want to pay. However, we suggest you pay at least the recommended amount so that it will even out your payments, including the half tax bill.

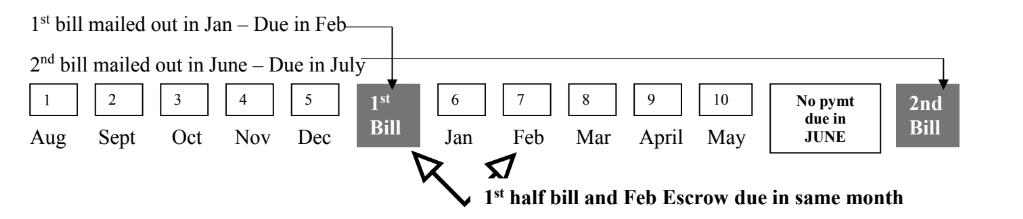

Why do I only get 5 coupons when there are 12 months in the year?

You will receive 5 coupons twice a year. You will pay 5 coupons, one per month, and then your half tax bill. See example below.

Example: Your half tax bill is $512.31. Your escrow coupon suggests $85.00 a month. You pay $85.00 each month beginning in August through December. This totals $425.00 (85.00 x 5 = 425.00). You will be billed for the balance of $87.31. (512.31 – 425.00 = 87.31)

Do I have to pay my January coupon plus my half tax bill?

Yes. You pay 5 coupons and 1 bill per half year.

I lost my coupons. What should I do?

You can send in your check but be sure to indicate to us that your payment is for an escrow account. At your request, we will send you replacement coupons.

Can I skip a month?

Yes. You may choose to make up that payment or we will bill you the balance on the half tax bill.

Can I pay more or less than listed on the coupon?

Yes. We will bill you the balance on the half tax bill.

Can I make escrow payments at any time?

Yes. Coupons are listed as due on the 10th of every month, but if you are a little early or late it’s ok. However, we do ask that December and May payments be made by the 10th so that all your payments are reflected on your half tax bill.

Can I put my escrow payment envelope in the real estate drop box?

Yes. This box is located in the Croghan Street parking lot adjacent to the courthouse building. You will find the drop box as you exit the parking lot on the driver’s side. This box is also used for regular tax payments.